Jefferson House - Creating Win, Win, Win, Win, Win, Win, Wins!

In August of 2018, we were approached by another investor, with the opportunity to buy this house. He already had the house under contract and wanted to wholesale it to us. Sometimes investors may be stretched too thin, by either time constraints or funding constraints, and they decide it would be better to sell the opportunity than do the project themselves. So they “wholesale” the deal; meaning they sell the rights of the purchase contract to another investor for a wholesale fee or “assignment fee.” This is a great way for the original investor to make some money for their time and marketing costs while still providing a great deal for the end flipper/investor.

One thing to keep in mind though, is it usually makes the transaction slightly more messy in that there is a level of separation between the seller and end investor, so the end investor knows less about the actual situation and gets more he said/she said information. You also get this with conventional realtor involved transactions, but realtors are better trained to put all the specifics of the transactions in writing, and they know to request supporting documents, security deposits, keys etc.

The house was owned by a landlord who had already sold off his other rentals. We were able to take a quick walkthrough of the house while the tenants were present (which is always awkward), and from that quick look around decided to buy. We paid cash and closed on the house 11 days later. Although we “paid cash” it wasn’t actually our cash, it was a private money loan.

Private Money Loan

A private money loan is a loan from someone (usually someone who doesn’t actively invest in real estate) that allows you to purchase a property “cash” quickly and is usually lent more based on the investors merit or the merit of the investment deal instead of a complicated underwriting process involving financials, credit reports, debt to income ratios, proof of income, etc like a conventional loan. Private money loan terms are also completely negotiable so they often vary greatly in repayments structure, points charged, interest rates, and term lengths. This private money loan was very simple because the lender knew and trusted us personally, and although she is not actively in real estate she understood that the deal had a ton of margin built in, so she felt comfortable lending on 100% of the purchase price. We agreed on the following terms: 12% interest only payments to be paid back monthly, for up to 6 months. So we bought the house for $85,000 (which she loaned us that full amount) and we would pay her $850 each month (interest) until we sold the house, at which time she would get her full $85,000 principle returned to her. Which means that if we had kept it for the full 6 months she would have made $5100 of interest on the loan.

Win, Win, Win

As far as the wholesaler goes, he had originally got the house under contract for $65,000 and assigned the contract to us for $85,000 so that when we closed on the property he made $20,000! That is so great for everyone involved, here’s why: The original landlord only wanted $60,000 for this house but the wholesaler offered him more than that, so the landlord is happy. Then we got the property at $85,000 which was still plenty of margin to make it a good deal for us, so we are happy. And of course the wholesaler is happy with making a quick $20,000 in the middle. It’s a win, win, win.

Ok so here’s where it got a little tricky for us. We closed on August 1st and had been told that the tenants would be moved out by then. Because it was a wholesaled transaction we couldn’t do a final walkthrough to verify. When we closed on the property we found out that the tenants had asked the landlord for more time to get moved out and that the landlord had in a nutshell told them, “sure, work it out with the new owners.” We also didn’t get any lease paperwork at the closing, or keys to the house, or security deposit transferred to us.

We went that day and talked to the tenants to try to figure out more and come to a solution. While we were there we took pictures of the house’s condition in case the tenants decided to take out their frustrations on the house.

Through talking to them we learned about all the usual landlord/tenant drama that had been going on and we also learned (for the first time) that they actually had not been paying their rent for the past couple months. We offered them what’s known as “cash for keys.” Essentially we would pay them $600 to move out by a certain date, and they accepted the offer. This allows us to move forward quicker, and alleviates the need to go through the eviction process. It also allows the tenant to get some money to help with moving costs, and then they won’t get an eviction on their record. The wholesaler also agreed to pay half of this $600 and because we were going to be out of town we had him deliver the money and sign off that they were moved out. If you ever do “cash for keys” you should NOT actually pay them cash, pay them a check, or something that has a paper trail, and have them sign off on some kind of agreement stating that they are ending their lease, that they have moved out not against their will, and that they have removed all their wanted personals belonging from the property (Or something to that effect). We learned that lesson the hard way; the wholesaler paid them actual cash and we got nothing signed off. They also had asked the wholesaler if they could leave some things in the garage and move them out in about a week, and since the wholesaler knew we would be out of town for about 3 weeks, he allowed it. We didn’t know about them leaving stuff in the garage and 3 weeks later when we returned and got started on the project we assumed it was all abandoned junk and threw it in the rolloff dumpster. They returned a few days later obviously livid that we would get rid of their “good stuff” and threatened both litigation and violence, although they did not follow through with either.

The house once it was vacated.

At the time of purchase, the house was a 3 bed 1.5 bath with 2 non-conforming rooms in the basement and a finished out basement living room. The original plan was to rehab the house for our rental portfolio, by adding 2 egress windows to the 2 non-conforming bedrooms and by adding a shower stall in the existing half bath we would turn it into a 5 bed/ 2 bath. The plan was to then rent it out for about $1700/mo and refinance into a conventional loan to increase our cashflow, put 30yr debt on it, pay back our private money lender, and get most of our money from the repairs back. We budgeted for a $22,300 rehab plus 4 months of holding costs ($5000) for a total budget of $27,300.

Here’s our initial scope of work and budget.

And our initial deal analysis.

The project went really smoothly, with very little variations from the plan. One thing we missed originally that we noticed right away, is that almost every window through out the house had a crack in it or didn’t function properly so we decided to replace all the windows throughout. Even with that added expense we were able to keep the project on budget and on time. We finished the project in about 6 weeks from when we got back in town and started the work.

Because we finished up with the rehab in November, we got very little interest in our rental listing. We considered 2 options, 1) drop the price dramatically for a 6 or 8 month lease to get a tenant in there until summer when we could demand more for rent OR 2) List it for sale and flip it. We decided to list it for sale to try to flip it. So we listed it with an agent on the MLS. The agent also included staging which really helps a house sell quickly, which we felt we would need that boost when trying to sell a house during the November holiday timeframe. A good realtor will also point out small things that need to be fixed, improved or tweaked to make the listing stand out and sell quickly. She suggested a deep cleaning, the staging, framing a mirror in the bathroom, and doing some yard work for curb appeal. We think it turned out beautifully!

We listed it for $165,000 which was admittedly a stretch and sold it for $155,000 with a cash offer. It sold in less than 2 weeks which is relatively short days on market for a listing in Lincoln in November. The purchaser was an out of state investor who was purchasing the house with cash as a long term rental. This seemed crazy to us because we would not be able to make the numbers work as a rental with a $155,000 purchase price but just goes to show that all investors have different buying criteria, and depending on the final investors end strategy you may even be able to make a full market value flip purchase work. We later learned that they would be renting the house to a sober living house program which allowed them to get a starting 2-3 year lease with a tenant who wanted to stay in the house forever (just renegotiating rent amounts each 2-3 years) meaning no vacancy, and the tenants would maintain the houses small repairs and take care of lawn, snow, utilities etc, so they had very little expenses and very little headaches.

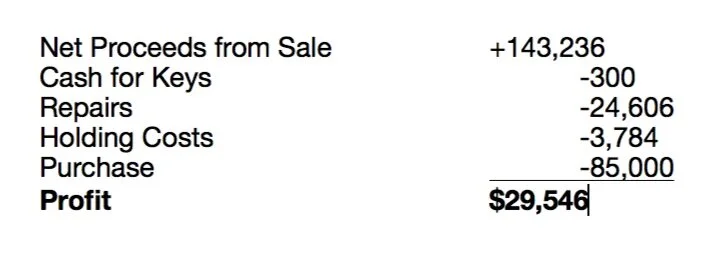

Final Numbers

All The Wins!

I think my favorite part of this deal is all the wins. Everyone involved from beginning to end got what they needed and wanted out of it, and it is a great demonstration of how when investors buy or flip properties, the community as a whole wins.

Landlord - got the amount he wanted +$5,000 and didn’t have to deal with his problem tenants.

Wholesaler - made $20,0000.

Private Money Lender - made $3,200 passively in 4 months on money that would have otherwise be sitting in a savings account making 0.2% interest.

Flipper (Us) - made $30,000 profit.

Buyers (investors) - Got a deal that worked for them, that would be a low maintenance, low capX, investment because we just re-did everything on it.

Community Program - They got a great house so that they can increase the amount of alcoholics/addicts that they can help for years to come.

Economy Boost - The National Association of Realtors released a study that each time a house is bought/sold, there is a $65,000 boost to the economy. When you look at all the other people that work on a deal like this you can see the boost. For instance, all of our contractors (plumbers, electricians, roofer, gutters, mason, flooring, lawn care, etc) and supply houses made the around $24,000 in repair costs, 2 realtors made commissions, our insurance agent, CPA, and 2 different title companies profited, plus the purchase of furnishings by the new buyer/community program for the house, and the list goes on and on.

To check out our other past deals click HERE